Understanding Bitcoin Market Participants – Vulnerabilities in the Price of Bitcoin Driven by Miners

Many analysts suggest there is a price floor in Bitcoin created by the breakeven price of a Bitcoin Miners’ cost of production. This assertion is inaccurate. In fact, selloffs in Bitcoin tend to accelerate as price gets closer to the miners’ cost of production. There is a consistent sell pressure on the price of Bitcoin, which stems from miners. Price support is actually established by miner capitulation and a net reduction in hash power on the network – favorable difficulty adjustments. Understanding game theory as it applies to the miners is critical.

A Miner’s cost to produce Bitcoin is derived by their electricity rate, as 95% of operating expense for a miner is electricity consumption. A miner will need Bitcoin to be at a certain price so the Bitcoin revenue they earn is greater than their electricity expenses. Miners with the lowest electricity rates have a significant comparative advantage.

We will analyze the following:

The Bitcoin Network:

Who are the market participants and how do they influence the price of Bitcoin?

Peeling back the layers of the Mining Network.

How Next Generation Mining Rigs Have Leveled the Playing Field – Keeping High Electricity Rate Miners in the Game.

Busting the Myth – “Breakeven Price of the Miner is a Price Floor.”

Impact of the 2020 Halving on the Bitcoin Industry – Hitting the Trifecta.

Difficulty: Satoshi’s Ingenious Network Stabilizing Mechanism – Understanding its Gravitational Pull.

How Miner Capitulation Accelerates Bottoms in Bitcoin.

The 3 Primary Types of Bitcoin Market Participants

Investment Funds – hedge funds, venture capital funds, family offices, and other institutional investors. They deploy almost entirely “long-only” strategies and rarely short. They typically have a long-term bullish bias, but have the ability to exit their positions at any moment and walk away if conviction is tested.

Hodlers – long-term accumulators seeking to maximize their Bitcoin Holdings. Hodlers have a long-term bullish bias and are less sensitive to price volatility than the Investment Funds. However, like Investment Funds, Hodlers can exit their entire position at any moment and walk away.

Miners – the backbone of the Bitcoin Network. Miners have more conviction in Bitcoin than Investment Funds and Hodlers. They have long time horizons. They invest in assets with long-term life cycles that cannot be repurposed nor quickly liquidated at fair market value. ASIC Mining Rigs have 3+ year life cycles and can only be used to mine Sha-256 Protocols (almost entirely Bitcoin). Bitcoin Mining Facilities have 5+ year life cycles and are typically restructured warehouses, specially designed for cooling mining rigs. On average, it will take a miner 18 months to breakeven after deploying capital to mining rigs, facility buildout, and electricity expenses. Miners are the main driving force of sell pressure on the Bitcoin Network. They receive all of the newly issued Bitcoin and they must sell Bitcoin in order to fund CapEx and OpEx for their mining operation.

Sell Pressure from Miners

There are approximately 54,000 new Bitcoin mined per month. If Bitcoin is trading at $10,000, that equates to $540,000,000 of new Bitcoin Supply being released to miners each month. A significant proportion of the 54,000 Bitcoin must be sold by miners to cover electricity expenses. Miners with higher electricity rates must sell a greater proportion of earned Bitcoin to cover their electricity costs. A majority of the capital outflow on the Bitcoin Network is driven by miners.

How Next Generation Mining Rigs Level the Playing Field

There has been a dynamic shift over the past 8 months due to the release of Next Generation Mining Rigs. Bitmain’s S17 Pro 50T consumes 50% more energy but produces 300% more hash power than the Bitmain S9 13.5T. Each S17 Pro 50T deployed is the equivalent hash power of four S9 13.5T mining rigs. Layer 1 & 2 Miners once represented a greater proportion of the network hash rate but they have much less incentive to upgrade to Next Generation Mining Rigs due to their low electricity rate. The Old Generation, S9 13.5T, uses 16nm Chips, while the S17 Pro 50T uses 7nm Chips. The innovation in the chips makes electricity less relevant as less watts are consumed per terahash. Next Generation Mining Rigs reduce the financial impact of higher electricity rates. Conversely, low electricity rates reduce the impact of the comparative disadvantage from inefficient, Old Generation Mining Rigs. For Layers 1 & 2, the opportunity cost of Bitcoin/Balance Sheet depletion in exchange for a lower cost of production by upgrading their mining rigs is not favorable based on the present percentage of old mining equipment still on the network. Layer 1 & 2 will remain competitive with old mining rigs as long as other layers are using old mining rigs. Mining is about survivability and being more competitive than your peers. As future hash derived from Next Generation Mining Rigs nears 100% in Layers 3-8, Layers 1-2 will then be forced to upgrade. The Halving will likely be the trigger for this event.

As your electricity rate increases, the opportunity cost of depleting Bitcoin Reserves/Balance Sheet to deploy capital towards the procurement of Next Generation Mining Rigs quickly becomes more favorable. In May of 2019, forward thinking miners began to anticipate the risk of shut off for the S9 due to the 2020 Halving. As a result, Layers 3-8 have aggressively led a Hardware Upgrade Cycle to Next Generation Mining Rigs over the past 8 months, while Layers 1 & 2 have continued running their Old Generation S9’s. The Next Generation Mining Rig Upgrade Cycle has increased the network hash rate by 80% and increased the proportion of the network hash rate represented by Layers 3-8 – diluting Layer 1 & 2’s share of the total network hash rate.

Consequently, this throws off projections by environmentalists crying foul on the Bitcoin Network. Many have predicted excessive consumption of energy as the Bitcoin Network exceeds specific hash rates, but since mining rigs are becoming radically more efficient the rate of energy consumption to network hash is significantly decreasing.

Understanding the Behavior of Bitcoin Miners

The analysis below illustrates the sell pressure driven by compressed margins on miners operating at various electricity rates and the subsequent relief in sell pressure once unprofitable miners shut off (the impact of Difficulty). We provide a game theory based simulation illustrating the behavior and decisions of miners in various scenarios. These are not Bitcoin Price Targets but rather illustrations of the impact on the mining network when Bitcoin is at specific price levels, before and after Halving.

For this simulation, a single, average kWh rate is used for all miners within a “Miner Layer.” This simplification consolidates the number of mining rigs “shutting off” at each Bitcoin Breakeven Price threshold. This creates waterfalls when miners shut off – amplifying the magnitude of subsequent adjustments in Network Difficulty and profitability of the surviving miners. Due to these assumptions, this model creates a “step graph,” which is a helpful illustration to conceptualize the reality, but smoother, more linear changes would better reflect real application.

For consistency, this analysis makes the following assertions:

Bitman S17’s represents Next Generation Mining Rigs and Bitmain S9’s represents Old Generation Mining Rigs. The percentage of Next Gen vs. Old Gen Hash is presently 61.38% and 38.63% of total network hash.

Electricity rates for each miner in a Layer is uniform and based on the average kWh rate for all the miners within a Layer. As such, in this analysis the breakeven cost of production for every miner within a Layer is equal and all shut off when that price is violated.

No new miners join the network over the course of the analysis.

The percentage of S17 and S9 Mining Rigs within each Layer varies based on the distributions in the table below:

Why we are confident in these assertions:

Blockware Solutions, LLC is one of the largest distributors of Bitcoin Mining Rigs in North America. We have clients and partners mining around the world. Our extensive reach: client base, strategic partners, business associates, and network represent over 20% of the Total Network Hash Rate.

We’ve had working sessions and peer reviews with the top Mining Pools and largest ASIC Manufacturers to deeply understand each region’s percentage of hash, electricity rate, and distribution of mining rig model.

We have visited 30+ MW Mining Farms in Chengdu, China, as well as, operations in the Hydro-Electric Rich Regions of Upstate New York and the Pacific Northwest.

Clients and Partners globally that all have sub 3c electricity, but most are mining almost entirely Old Generation Mining Rigs. They have less incentive to upgrade to Next Generation Mining Rigs because their low electricity rate diminishes the benefits of more efficient mining rigs and does not justify the extensive cost to upgrade to Next Generation Mining Rigs, yet.

Bitcoin at $10,000: Healthy Margins for Every Layer

When Bitcoin is trading at $10,000 every Miner Layer enjoys healthy margins, especially the S17 Mining Rigs. However, for Layer 8 Miners, S9 Mining Rigs are nearing shut off price. Even at $10,000 BTC, 96.3% of the Bitcoin generated by S9’s in Layer 8 will need to be sold to cover electricity expenses.

Based on the above scenario, miners must sell a minimum of 39.12% of the Bitcoin mined ($211,225,815 equivalence) each month just to cover electricity expenses. This means that new cash deployed by Investment Funds and Hodlers must amount to $211,225,815 per month in order to match fiat outflows generated by miners funding their operations. The miner sell pressure is consistent, while new capital raised by Investment Funds and Hodlers is sentiment driven and varies based on stages in the market cycle.

Bitcoin at $7,500: Busting the Myth – “Breakeven Price of the Miner is a Price Floor”

As Bitcoin’s price decreases miners experience margin compression. As a result, they are forced to sell a larger percentage of their rewards in order to cover electricity expenses (revenue is decreasing, yet expenses remain the same).

Let’s examine miners in Layer 6, 7, & 8 operating S9’s: as the price of Bitcoin approaches and penetrates a miner’s breakeven price, the miner now operates at a loss. They have to sell all of their mined Bitcoin and additionally, Bitcoin Treasury/Reserves to cover electricity expenses. This introduces additional sell pressure to the market beyond newly mined Bitcoins – the opposite of support.

Understanding Real Operational Results vs. On Paper Operational Results

Many believe miners can simply shut off when they reach breakeven and will never operate at a loss. This is a misconception that is grossly misunderstood. Contractual obligations and failed treasury management frequently lead miners to operate at a loss. This forces miners to sell more Bitcoin than they mined; depleting Bitcoin Treasury and bringing additional sell pressure to the market:

Miners have negotiated contracts with the utilities to achieve lower electricity rates but those rates are contingent on minimum electricity usage thresholds. Therefore, some miners can find themselves mining at a loss for a given period as they must continue mining to meet their minimum usage requirement; otherwise they will lose their long-term rate. They cannot simply shut off for a week or month (when unprofitable) and wait for Bitcoin to rebound.

Many miners send their mining rigs to colocation facilities. These colocation contracts lock in a miner for 1 to 2-years at a fixed, monthly fee per mining rig (determined by an electricity rate). If a miner defaults on these monthly payments, the colocation facility can confiscate the mining rigs. As a result, many miners will mine at a loss for several months to avoid default and risk losing their expensive mining rigs

Miners turn into speculators. Miners are humans and therefore, are not immune to Human Psychology. Many miners attempt to implement guidelines for the timing and quantity of Bitcoins to be sold. Many miners may sell all their Bitcoin upon receipt, weekly, monthly, or may just sell enough to cover electricity expense. Unfortunately, when Bitcoin rallies miners tend to turn into speculators with the hope of catching a rally. We share analyses with one of the largest OTC Desk’s in the Crypto Space. In September of 2019, we discussed how some of the OTC Desk’s mining clients had deviated from their scheduled liquidations and elected to hold mined Bitcoin during July and August – thinking Bitcoin would continue running. Bitcoin topped late June and those miners had to puke their coins later in September and October at much lower prices. Such scenarios accelerate sell offs in Bitcoin as additional sell pressure from liquidating Bitcoin Treasury is created beyond just newly mined Bitcoin.

To summarize: When Bitcoin was at $10,000, only 39.12% of the total monthly Bitcoin mined needed to be sold to cover electricity expenses. Once Bitcoin dropped to $7,500, profit margins for all miners decreased, and caused S9 Mining Rigs to operate at a loss for miners in Layer 6, 7, & 8. As a result, 53.18% of the total monthly Bitcoin mined needed to be sold to cover electricity expenses.

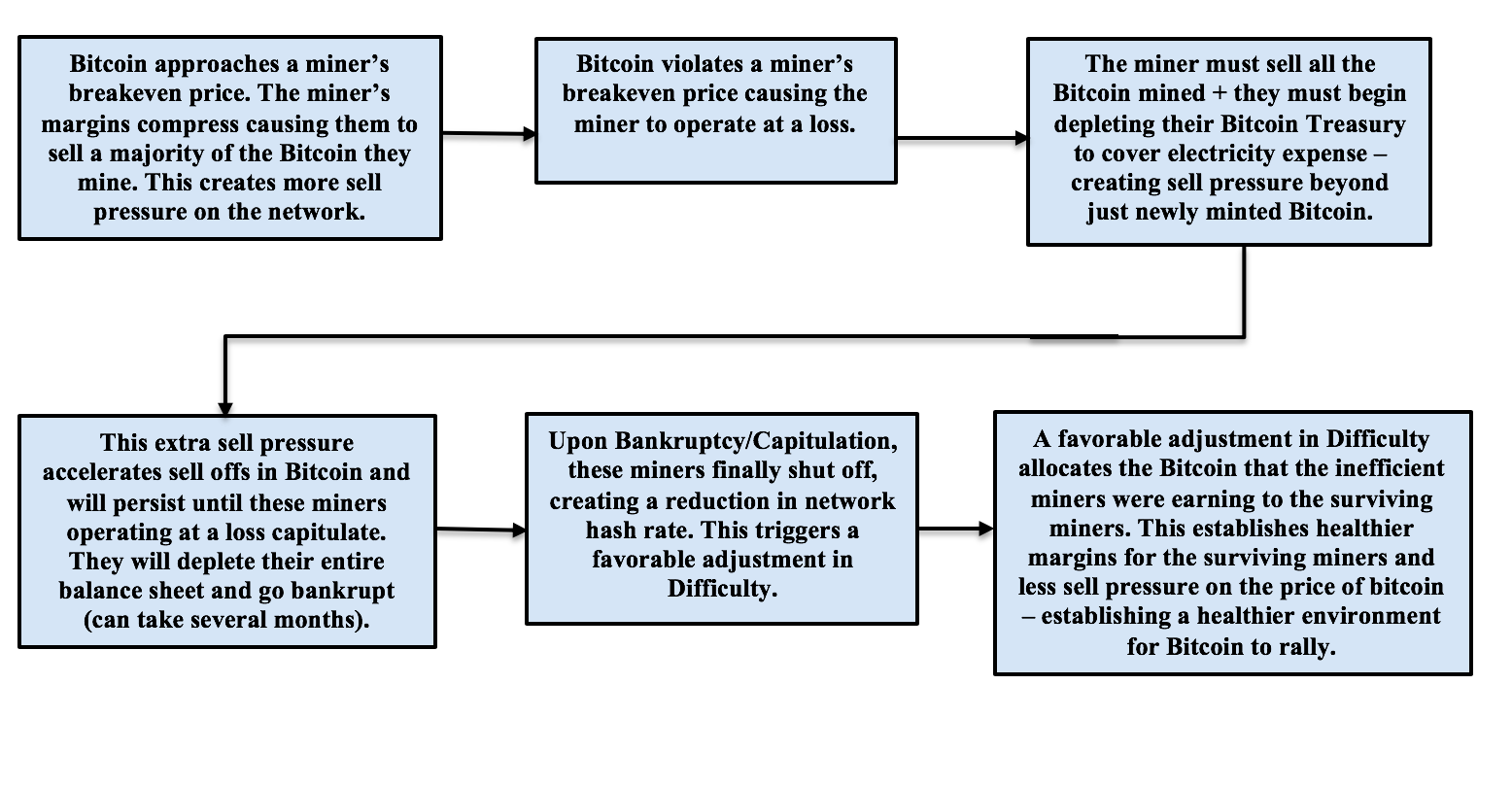

The Miner Capitulation Roadmap

Bitcoin at $7,500 – Prior to Halving

There are many inefficient, Old Generation Mining Rigs that are mining Bitcoin (Layers 3-8 running S9’s). These miners apply the most sell pressure to Bitcoin as a majority of their mined Bitcoin needs to be sold to cover electricity costs. Miners in Layers 3-8, running S9’s also have the highest breakeven prices. They represent the current pressure point, in the mining network, that is causing downward pressure on the price of Bitcoin.

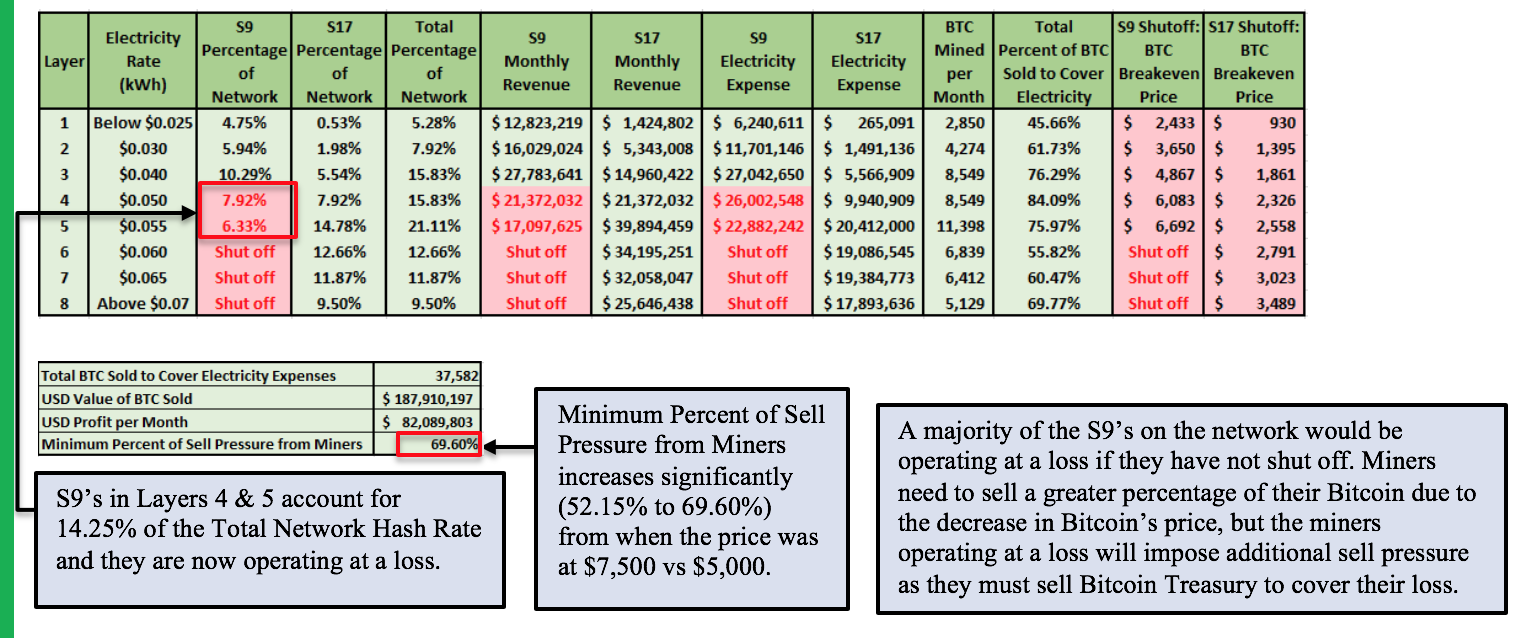

Bitcoin at $5,000 – Prior to Halving

In the scenario Bitcoin continues to decline to $5,000, S9 Mining Rigs in Layers 6, 7, & 8 will have to shut off. This results in a favorable difficulty adjustment which improves the breakeven prices for all the surviving miners. However, despite the benefits of the difficulty adjustment, with Bitcoin at $5,000 Layer 4 & 5 Miners running S9’s will operate at a loss. The S9’s in Layers 4 & 5 represent the new pressure point in the mining network that creates more vulnerability in the price of Bitcoin. These S9’s will follow the Miner Capitulation Roadmap discussed earlier: they will begin to deplete their Bitcoin Treasury to cover electricity costs until they go bankrupt and are forced to shut off – increasing sell pressure on Bitcoin until shut off occurs.

Bitcoin at $5,000 – After Inefficient Miners Shut Off

After operating at a loss for long enough, Layer 4 & 5 Miners running S9’s shut off – resulting in a favorable difficulty adjustment for the surviving miners. The shut off S9’s in Layers 4 & 5 accounted for 14.5% of total network hash rate. This means that after shutting off, the 14.5% of newly mined Bitcoin previously being collected by Layer 4 & 5 S9’s will be redistributed to the surviving miners. This reallocation will improve the surviving miners’ breakeven prices and reduce the sell pressure on Bitcoin because the surviving miners’ margins will improve. Newly mined Bitcoin is now being accumulated by Strong Hands (more efficient miners). The minimum percent of sell pressure from miners is reduced from 69.60% to 51.49%

Bitcoin at $5,000 – Post Halving

In the Scenario Bitcoin is at $5,000 through Halving, the network will have a healthy cleansing that best positions for Bitcoin to once again reach New Highs (even an $8,000 Bitcoin Price will provide a material cleanse).

The May, 2020 Halving will cut the rewards released to miners by 50%. Mining Revenue will decrease by 50% in Bitcoin denomination. For mining margins to stabilize, the price of Bitcoin must increase so miners receive the same mining revenue in US Dollar denomination. This is critical so miners can fund their electricity expenses. There will be extreme miner capitulation as all S9’s above 2.5c (Layers 2-8) will be operating at a loss and miners at 6.5c and above (Layers 7 & 8), running S17’s, will be operating at a loss – pressuring them to shut off.

Bitcoin at $5,000 – Post Halving – After Inefficient Miners Shut Off

Satoshi’s Ingenious Network Stabilizing Mechanism: Understanding Difficulty’s Gravitational Pull on Miners’ Profit Margin

If Bitcoin remains at lower price levels for 2-4 months, Post-Halving, many miners operating at a loss will be forced to shut off. After all the miners that are operating at a loss shut off, the miners that survive experience significant margin relief. We will witness a network in short-term chaos, but difficulty adjustments will reinstate stability once the inefficient miners shut off.

Difficulty: The Bitcoin Protocol has a self-correcting mechanism that stabilizes the Mining Network’s profit margins to assure adequate incentive for miners is provided to continue securing the network. Miners are the backbone and security layer of the Bitcoin Blockchain. The Difficulty Mechanism assures efficient miners are incentivized to carry out their role. It is one of the most undervalued and minimally understood phenomena in regards to Bitcoin Mining. If the Mining Network experiences margin compression, the least efficient miners will get picked off layer by layer. As inefficient miners shut off, the network now takes more time to mine a block as there is less hash to timely solve blocks on the network. If the network is not solving blocks within 10 minutes, there will be a favorable difficulty adjustment. The share of rewards that were once being earned by miners that shut off now get allocated to the miners that remain on the network. This is considered a favorable difficult adjustment. This process will continue to play out until profit margins normalize or even become highly lucrative for the surviving/most efficient miners. Mining is all about survivability. Difficulty adjustments will reduce the impact of Bitcoin Price Corrections for miners operating efficiently enough to survive.

The Shakeout Before the Breakout – Hitting the Trifecta

1. The Halving – Improvement in Supply Side Economics

Many market participants speculate on the future of Bitcoin. What is certain is that come Mid-May, 50% of the potential sell pressure on Bitcoin will be removed as the newly issued mining rewards are halved. 50% less supply issuance will reduce the modest, but ongoing downward shift in Quantity of Bitcoin Supplied, which is solely dictated by the Bitcoin Protocol’s code. This is a positive catalyst for Bitcoin Price.

2. Improvement in Demand Side Economics due to Halving Induced Positive Sentiment

An economist can say Bitcoin is worth nothing as it is presently too volatile to be an effective store of value and too slow to be an effective payment platform. A Bitcoin Maximalist can say Bitcoin is Digital Gold because it has the property of scarcity. At the end of the day, the Market determines Bitcoin’s price.

Historically, Bitcoin runs up into Halving and has continued an uptrend/Bull Market Cycle (there are always multiple, severe corrections along the way). Most market participants deeply understand these historical trends. People can claim the Halving is priced in, but it is not provable unless you can confirm with a majority of market participants that they have deployed their cash positions and have met their price targets. Opinions differ and most market participants have some amount of a cash position. A run up into Halving is on everyone’s mind and develops positive sentiment on the demand side. This psychological positive sentiment will have market participants anticipating and prepared to deploy cash positions towards upward momentum. Everyone has seen the run ups into Halving and everyone, at some point, has missed remarkable rallies in Bitcoin – it is why Bitcoin has more Hodlers than any other asset. Hodlers refuse to get burned again and miss an amazing run. This is a market and markets are driven by Human Psychology. The Human Psychology of the Bitcoin Market Participants, prior to Halving, is to lean bullish. This creates positive sentiment on the demand side of Bitcoin.

3. Opportunistic Environments Capitalized on by Access to Debt

After the Bitcoin Network experiences significant or sustained favorable difficulty adjustments, the likelihood of a bottom in Bitcoin Price is enhanced (https://bitcoin.blockwarepool.com/mining-data). This is because newly mined Bitcoin is now being distributed to and accumulated by the most efficient miners with healthy balance sheets. The amount of Bitcoin (Bitcoin denominated) that the surviving miners receive are directly proportional with the amount of Bitcoin that was being distributed to the miners that have shut off. These rare, lucrative opportunities allow surviving miners to accumulate copious amounts of Bitcoin.

A new lever of stimulus is quickly becoming accessible to many market participants. Through Centralized Lenders and Decentralized Lending Platforms, miners are able to access debt by collateralizing their mined Bitcoin in exchange for cash or stable coins. Now miners can hold their Bitcoin rather than selling it, yet still meet the obligations of electricity expenses, Collocation Contracts, procurement of more mining rigs, or further infrastructure buildout. This dynamic reduces sell pressure from the network, which we believe will be a significant catalyst towards Bitcoin price appreciation.

When more Bitcoin gets accumulated by Strong Hands, it is likely to be held for the long-term and establishes the equivalence of removing supply from the network. These experienced miners have witnessed miner capitulation before and have robust amounts of Bitcoin on their balance sheets. Many elect to hold their Bitcoin when they perceive price to be low. Access to debt in the market will be an additional tool for miners with significant quantities of Bitcoin to hold their Bitcoin during price corrections, which will reduce sell pressure and accelerate bottoms in corrections. Although this can be a source of stimulus for the network –how it will end is something to be cautious about as debt typically ends unfavorably when coupled with excessive speculation.

Combining the above three forces, one can expect the creation a powerful multiplier effect as the supply side and demand side economics for Bitcoin Price are radically improved. This is what makes Halving so bullish for the price of Bitcoin.

Bitcoin Rallies to $7,500 – Post Halving – How Miner Capitulation Accelerates Bottoms

After miners have shut off (capitulated), newly mined Bitcoin is allocated to the most efficient miners, which minimizes sell pressure on the Bitcoin Market as these miners are well above their breakeven prices. Just as there is friction with miners shutting off when Bitcoin sells off, there is friction with miners turning back on when Bitcoin rallies. Many miners may be a few months behind on electricity, hosting, or land lease payments and cannot turn back on without paying multiple missed months. This allows price to rally more easily, and as price rallies, a smaller percentage of the newly mined Bitcoin will need to be sold to cover electricity costs (which remain constant) as the miners that have survived have healthy margins.

Miners that shut off are not able to turn on simultaneously with price rallies in Bitcoin. This is similar to the friction experienced when price was dropping and miners operating at a loss were unable to shut off immediately. When Bitcoin Price rallies after significant difficulty adjustments it creates an advantageous environment for efficient miners who did not need to shut off to accumulate a larger piece of the pie.

Bitcoin Rallies to $10,000 – Post Halving – How Miner Capitulation Accelerates Bottoms

Friction keeps inefficient miners from turning back on in a timely manner. As a result, newly mined Bitcoin Rewards are accumulated by efficient miners so minimum sell pressure from newly mined Bitcoin continues to decrease. With Bitcoin at $10,000, the minimum percentage of sell pressure from miners is reduced to 23.33%.

The comparison below best illustrates how healthy a cleansing is by removing inefficient miners and reducing potential sell pressure on the network:

The Cycle Repeats: Bitcoin at $10,000 – Post Halving – After Rallying with Difficulty Adjustment

After a long enough rally in Bitcoin price, inefficient miners are able to turn back on. This results in an unfavorable difficulty adjustment as more miners compete for the same amount of Bitcoin. This results in an increase from 23.33% to 51.49% in the minimum percent of sell pressure from miners.

This is an excellent example of the gravitational pull of Difficulty, except we witness margin compression due to unfavorable difficulty adjustments from miners joining the network. Difficulty stabilizes the mining network and provides just enough incentive to maintain Bitcoin’s security layer. Over time, margins remain just plentiful enough for committed, efficient miners to remain profitable despite price fluctuations in Bitcoin. Ultimately, Difficulty will wipe out those operating inefficiently, but when the price of Bitcoin appreciates significantly, in a short timeframe, even inefficient miners can enjoy healthy margins.

Many fear Halving but if you understand the psychology of the miner and how game theory will drive behavior, Pre and Post Halving, the efficient miners should welcome it. Miners, sub 6.3c, with the most efficient mining rigs will feel pain but will survive. Bitcoin naturally has a sell pressure from miners that chips away at Bitcoin’s price. Post Halving less new fiat will be required to counter balance miner sell pressure. As a result, Investment Funds and Hodlers will be more capable of stabilizing the downward pressure by injecting enough new fiat into the system to achieve long-term price appreciation.

The Blockware Mission: In this paper, we illustrate the necessity for miners to achieve every possible comparative advantage over their peers in order to survive and thrive. Rather than just writing research we have taken the initiative to offer the most competitive package for US Miners. Our goal is to bring as much hash to the US and keep US Miner’s competitive with the rest of the World. Blockware Mining has S17+’s on-site at our hosting facility for sale and will be offering a 24/7 turn-key hosting solution priced between 5.7c – 6.7c kWh to ensure robust profit margins for US Miners. This offering will have miners up and hashing immediately – no more 2.5 month lead times and delays from Chinese Manufacturers. We will also offer a leading firmware for a one-time installation fee (rather than the Dev Fee in perpetuity) that gets S17+’s hashing between 95T-105T. The Blockware Mining Hosting Facility will be managed by Navier.com – a leading team that has been mining since 2011. Miners will no longer experience fried machines by inexperienced techs managing your expensive machines. These experts at Navier.com control 12% of the Z-Cash Hash, 22% of the Dash Hash and 16% of the SIA Coin Hash. Marrying all of these value adds will best position US Miners to remain competitive – bringing as much hash as possible to the US.

Blockware Solutions, LLC is a Blockchain Service Provider and industry leader in Bitcoin & Cryptocurrency Mining Services. Blockware assists clients with the acquisition & sale of mining rigs direct from foreign manufacturers and through trusted P2P domestic channels (32,000 ASICS sold over the past 12 months). Blockware provides access to a thoroughly vetted network of hosting & colocation facilities across the US (26MW’s placed over the past 12 months). Additionally, Blockware Solutions is a professional mining pool operator and also provides research / consulting services on a variety of other opportunities in the Blockchain and Cryptocurrency Mining Space.

Blockware is a team with professional experience in Asset Management, Software Engineering, Proprietary FX Trading, and Management Consulting. Co-Founder and CEO, Matt D’Souza, currently manages Blockchain Opportunity Fund, LLC: a mid-large size hedge fund focused solely on digital assets and the Blockchain Industry and is a Co-Founder and CEO of Blockware Mining, LLC: a US-based mining operation running 180PH in Kentucky. Together with President, Michael Stoltzner, they strive to bring as much hash to the US as possible.

Blockware Solutions presently operates one of the Top 20 Largest Bitcoin Mining Pools in the World, we are the 3rd largest Validator for the Loom Network, and are part of SKALE Labs’ Alpine Team as a future Validator for their network. We are consistently positioning for new ways to actively support growing the Blockchain Ecosystems.

We are always looking to network, learn and educate. We appreciate any feedback and look forward to a continued discussion!

https://BlockwareSolutions.com

https://bitcoin.blockwarepool.com/

https://BlockwarePool.com/Loom

Follow us on Twitter: @BlockwareTeam, @Mjdsouza2, @S_Chwarzynski - for direct comments or questions, email us: Contact@BlockwareSolutions.com

Co-Authored by: Matt D’Souza, Sam Chwarzynski, Mason Jappa, and George Adams

DISCLAIMER

THERE CAN BE NO ASSURANCE THAT THE PROJECTIONS, ESTIMATES OR THE UNDERLYING ASSUMPTIONS WILL BE REALIZED AND THAT ACTUAL RESULTS OF OPERATIONS OR FUTURE EVENTS WILL NOT BE MATERIALLY DIFFERENT FROM THE PROJECTIONS. UNDER NO CIRCUMSTANCES SHOULD THE INCLUSION OF THE PROJECTIONS BE REGARDED AS A REPRESENTATION, UNDERTAKING, WARRANTY OR PREDICTION BY BLOCKWARE SOLUTIONS, LLC OR BLOCKWARE MINING, LLC, OR ANY OTHER PERSON WITH RESPECT TO THE ACCURACY THEREOF OR THE ACCURACY OF THE UNDERLYING ASSUMPTIONS, OR THAT BLOCKWARE MINING, LLC WILL ACHIEVE OR IS LIKELY TO ACHIEVE ANY PARTICULAR RESULTS.