Halving, Antminer S9 Obsolesence, & Miner Capitulation

Halving, Antminer S9 Obsolesence, & Miner Capitulation

Encoded in the Bitcoin protocol is a reduction in the block subsidy every 210,000 blocks (roughly four years). With the subsidy typically accounting for >98% of miners revenue, the event is of significant importance to every stakeholder in the network.

The Bitcoin Security Budget

Miners invest billions of capital into hardware, facilities, power, and labour with the aim to ROI on their capital. The money miners invest in the network can largely be considered the network’s security budget.

If this capital is not put to use for the purpose of appending blocks in the Bitcoin blockchain, the security budget is effectively reduced. Reduction in the security budget impacts practically every stakeholder in the network – holders, exchanges, businesses, developers etc.

Long-Term Bitcoin Security - How Will Miners Be Compensated for Revenue Reduction?

Increases in transaction fees or price are the two ways miners can be compensated for the decline in block subsidy. While many hold hopes for transaction fees rising over the long-term to compensate, there has been very little to back this up apart from increases observed to date in transaction fees as percentage of total rewards.

Industry professionals have noted concern for Bitcoins security long-term as the block subsidy continues to decline. Braiins co-CEO Pavel Moravec doesn’t see the subsidy declining as an issue in the short-run but is unsure how the dynamics will play out in the long-run.

“In the long-run, I am slightly concerned. I don’t know how the economics will play out. I don’t see it as a problem in the short-term. It should not be an issue over the next two halvings.” Pavel Moravec

Bitcoin developers also don’t have the answers. At an event in February, Soona Amhaz asked a panel “once we can’t depend on block rewards as a sort of incentivization for miners, will transaction fees be enough?”.

“This is the hardest question you can ask about Bitcoin. We hope so. It’s really hard to know” Tadge Dryja

Halving & Price

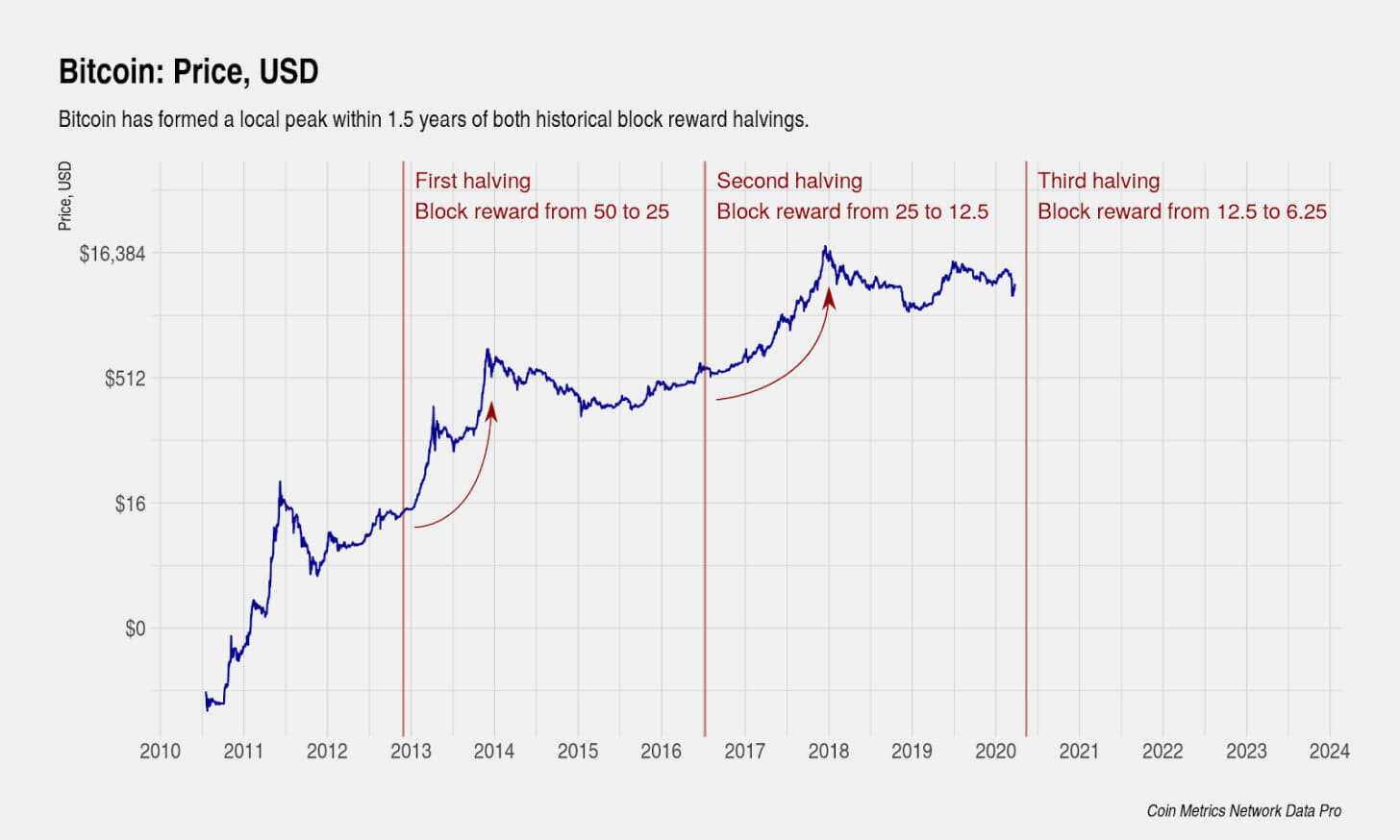

The halving acting as a catalyst for price increases in Bitcoin is another widely discussed topic. While price did increase in the lead-up to the first two Bitcoin halving events, the lead-up to this third halving has demonstrated that bullish price increases as a result of halving events are anything but guaranteed.

The post-halving $55k forecast derived from Plan B’s Stock-to-Flow model has likely been the most widely circulated price prediction. However, there have been countless criticisms of the model including a recent comment from Nic Carter.

“I make no secret of the fact that I’m skeptical of the model. I don’t believe issuance changes represent new information being brought to market, so treating them as if they are information shocks seems incoherent.” Nic Carter

Similar to transaction fees, there are no guarantees regarding how Bitcoin price will behave in relation to its supply issuance halving. Furthermore, this information has been publicly known from the inception of the network.

Halving Simulation & Antminer S9 Obsolesence

In the >50% March BTC price decline, we saw somewhat of a halving simulation. Bitcoin price depreciated by over half its value in the course of two days, bringing roughly 16% of the network below cash flow breakeven levels.

With the price drop, the inefficient miners who were lowest on the cost curve became unprofitable and were forced to sell all of the coins they generated while also depleting treasury reserves. They eventually reach the point of capitulation where they are forced to turn off their equipment.

The halving will effectively repeat this process unless prices can rise in the meantime. Miners will struggle directly after the halving but the difficulty will ultimately adjust and those efficient miners that remain will receive the rewards which were previously distributed to those lower on the cost curve. Recent research from Blockware Solutions presents data that argues that this results in favourable market dynamics. As inefficient miners are removed, those efficient miners that remain have healthier balance sheets and need to sell less of their generated BTC in order to meet fiat-denominated costs.

Another impact of the halving is the obsolescence of old hardware. The Antminer S9, a rig which has been widely used by miners since its launch in May 2016, will likely only be able to mine in regions where electricity rates can be secured at <$0.01. Anecdotal reports in the last quarter of 2019 noted the transition of Antminer S9 rigs from China to regions in Kazakhstan and Iran where cheap coal-power agreements can be secured. Recent Bitcoin nonce distribution analysis has highlighted that large amounts of S9 mining rigs have likely already been turned offline.

Halving Predictions…

The halving has been surrounded by predictions, projections, and forecasts. The spread of COVID-19 demonstrates the futileness of forecasting uncertain variables. Envision how many five-year business plans took into consideration the possibility of a pandemic which would bring the business world the standstill.

Therefore, predictions relating to price and transaction fees should all be considered extremely speculative. Less speculative is the fact that the mining industry as a whole operates just above the margin. While a significant percentage of inefficient miners were removed as a result of the March declines, some of these will have reentered given the recent price increases. However, the halving will be another event which will put severe pressure on miners. At current prices, a myriad miners operating with high electricity costs and old-generation equipment will be pushed below their breakevens and those most efficient miners will be strongly positioned to receive their rewards when difficulty adjusts to reflect the mass removal.

By Miner Update: https://minerupdate.substack.com/p/minermovements-9